People drive our success.

We seek highly motivated, intellectually honest, and humble individuals who bring diverse experiences and perspectives to their work.

What is viking?

Viking was founded in 1999 with the goal of building an enduring asset management firm. We’ve built a deep team that cares about making a positive impact and is open to new perspectives. For over two decades, we’ve fostered a culture of rigorous analysis, thoughtful investment risk-taking, and strong compliance that benefits our investors.

who works here?

Over 275 Vikings work across our operations and investment teams, each of whom provides diverse experiences, expertise, and dedication to excellence that enable our success.

what do we value?

With intellectual curiosity and thoughtfulness, we draw on each other’s unique perspectives and experiences to solve problems and improve the quality of everything we do. We aim to treat each other with fairness, integrity, and respect.

How can you make an impact at Viking?

We provide the tools, access to senior leadership, and opportunity to enable everyone to contribute ideas that make a difference. Given the relatively small size of our firm, each role is valuable and has an impact on investors and colleagues.

Operational excellence is essential to our success and longevity

We make significant investments to maintain a team of exceptional professionals across Viking’s functions. Operations professionals at Viking bring deep expertise in various areas, among others:

- Accounting

- Risk management

- Compliance

- Talent

- Cybersecurity

- Technology

- Relationship management

- Trade execution

Our operations teams represent a variety of educational and career backgrounds. Our diverse skills, individual accountability, and team orientation deliver strong outcomes for investors.

Building an enduring firm together through operational and investment excellence

The performance of our operations and investment teams is intrinsically linked. Only when both teams excel together can we fulfill our mission to build an enduring asset management firm.

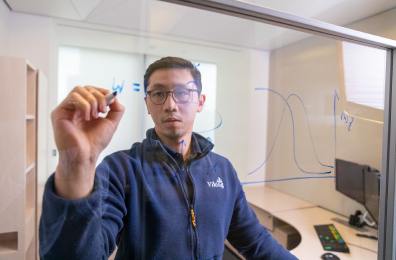

See what our operations professionals love about Viking

“Every single person comes into work wanting to be better than they were the day before.”

“I enjoy my job every day. I wake up excited to come here.”

“At Viking, technology is valued and celebrated.”

We believe that superior risk-adjusted returns are a direct result of our efforts to recruit, train, and mentor investment talent.

We invest with deep sector expertise grounded in thorough bottom-up research and analysis

Public equity

Our team seeks to identify attractive long and short investments and concentrates capital on ideas with the highest profit potential.

Private equity

We identify disruptive industry themes and businesses with exceptional management teams. Our vast industry network, reputation as a constructive capital partner, and targeted outreach allow us to source compelling private investment opportunities.

Credit and structured capital

We strive to be a responsive and creative solution provider for management teams and business owners seeking alternatives to traditional equity financing.

Creating future investment leaders

We view investing as a craft best taught through an apprenticeship model, where junior team members learn our investment process with guidance from our senior investors.

We develop exceptional investment teams that apply sound and rigorous investment processes where superior risk-adjusted returns are a natural outcome of their efforts.

See what our investment professionals love about Viking

“We can bring our unique experiences and perspectives to Viking and feel appreciated.”

“It’s exciting to be among a group of exceptionally talented and driven people every day.”

“Viking provided me with a lot of resources, mentorship, and targeted training.”

Real-world lessons.

Real-world impact.

Our 10-week summer internship programs are a key source of next-generation talent at Viking. We provide our interns with impactful projects and essential skills.

The culture is very collaborative and supportive, and we all learn together, which includes learning from our mistakes. We share what we’ve learned – both the positive and negative – to help improve our process going forward.

– Sara Carter, Portfolio Manager, Public Equity

Why apply to our internship programs?

Learning

Collaboration

Impact

Exposure

Opportunity

Internship opportunities

Public equity internship

Partner directly with portfolio managers and senior analysts to identify and evaluate investment opportunities through our fundamental, research-centric approach.

Private investments internship

Partner directly with managing directors and principals to source, conduct due diligence, and execute on private equity investment opportunities.

Data science internship

Partner with the data science team to develop predictive analytics on companies, sectors, and macroeconomic trends, and evaluate their potential impact.

Frequently asked questions

Job opportunities and application process

Do you have any job openings?

Open roles are posted here. If there isn’t an open role that’s a direct fit for your skills and experience, we encourage you to apply for an opportunistic role.

What roles do you hire for?

We hire experienced professionals in all departments. In our commitment to excellence, we are open to hiring the best candidates opportunistically.

CAN I apply to more than one role?

Do you accept international applicants?

Qualifications and specializations

what do you look for in a candidate?

Do I need a background in Finance?

Culture and environment

How do you support the career development of employees?

How does Viking’s culture differ from other firms?

Interview process

What is the interview process like?

Our interview process varies by team and role but typically consists of multiple rounds, with several interviews per round. Our interview panels are representative of the relationships a candidate would have within the firm once hired. Interviews explore a candidate’s motivation for the role, communication skills, alignment with Viking values, competencies, and technical skills. Additionally, processes for some roles may include a case study, presentation, or writing sample.

Will my interview take place online or in person?

Frequently asked questions

Job opportunities and application process

Do you have any job openings?

If you are interested in an investment role at Viking, we encourage you to apply to our opportunistic posting. Our search for talent is ongoing and not confined to specific recruitment cycles.

What roles do you hire for?

We hire experienced professionals in all departments. In our commitment to excellence, we are open to hiring the best candidates opportunistically.

CAN I apply to more than one role?

Yes, you are welcome to apply to more than one role. However, most positions require a specific skill set, making qualification for more than one role at a given time unlikely.

are there investment roles in offices other than new york?

The majority of our investment team are based in our New York office, with a small number in San Francisco and London. Role location will be clearly indicated in the job description.

Do you accept international applicants?

Yes, we encourage candidates of all backgrounds to apply.

Qualifications and specializations

what do you look for in a candidate?

We have a highly selective hiring process and do not hire in large numbers. We’re looking for candidates who exemplify our values and demonstrate a personal dedication to excellence in their work.

Is private equity and/or investment banking experience required for investment roles?

Do I need to have an established investment process before applying?

We are committed to our investment process and believe it can be taught. Candidates do not need to come in with their own process. We are looking for candidates who can demonstrate the technical skills necessary for the role.

Do I need to specialize in a sector before applying?

Culture and environment

How do you support the career development of employees?

How does Viking’s culture differ from other firms?

Interview process

What is the interview process like?

Our interview process varies by team and role but typically consists of up to three rounds, with two to three interviews per round. Our interview panels are representative of the relationships a candidate would have within the firm once hired. Interviews explore a candidate’s motivation for the role, communication skills, alignment with Viking values, competencies, and technical skills. Additionally, some roles may include a case study, presentation, or writing sample.

For investment roles, we also assess analytical thinking and market sizing skills, foundational finance knowledge and a candidate’s approach to investing. If you’re interviewing for a public equity role, be prepared to speak about at least one stock in depth.

Will my interview take place online or in person?

Frequently asked questions

Team responsibilities

What does the Viking Public Equity team do?

The public equity team becomes experts in their sectors by reviewing real-time data, analyzing company financials, and speaking with industry professionals. They frequently engage with the senior leadership of multi-billion-dollar companies to understand and assess their strategies, and they partner with Viking research specialists to source unique qualitative and quantitative inputs.

Analysts and senior analysts form a view of a company and its value by distilling a large volume of research into a set of key drivers for industry, company, and stock price performance. They identify actionable investment ideas and communicate their recommendations to portfolio managers and the CIO.

what does the viking Private investments team do?

The private investments team, comprising our private equity and structured capital strategies, sources and identifies investment opportunities and investable themes by leveraging Viking’s vast industry network, strong referral base, and targeted company outreach.

They conduct rigorous fundamental research to gain investment conviction on prospective investments by:

- Analyzing company financials

- Performing company and industry research

- Interacting with service providers and/or co-investors

- Conducting intensive operational due diligence and management checks

The private investment team also monitors and supports current portfolio companies by maintaining continuous dialogue and leveraging Viking’s extensive experience, network, and resources to provide advisory support.

what does the data science team do?

The data science team collaborates closely with the investment team as integral members of Viking’s sector-aligned research specialists that cover all funds. They focus on:

- Proprietary dataset development

- Evaluation of datasets for purchase

- Rapid data wrangling and prototyping

- Advanced data visualization

- Modeling

- Predictive analytics

Internship details

Does Viking consider interns for full time opportunities?

how many interns do you hire each year?

where are the internships located?

who should apply to the investment internships?

Investment internships are open to current first-year MBA students. While a foundational understanding of finance and modeling is important, interns receive on-the-job training to build their investor skill set. Prior experience in private or public equity is only required for the private equity internship.

In addition to demonstrating Viking values, we are looking for candidates who are self-motivated, proactive, and demonstrate:

- Intellectual curiosity

- Strong quantitative and analytical skills

- A passion for research and investing

- Independence of thought

- Strong communication skills

who should apply to the data science internship?

Data science internships are open to students in Master’s or Ph.D. programs (third year and above) in data science, economics, finance, statistics, or related fields.

In addition to demonstrating Viking values, we are looking for candidates proficient in Python and statistical libraries. A working knowledge of SQL, BI software (e.g., Tableau), and cloud technologies is preferred but not required.

A strong candidate has the following characteristics:

- Passion for research

- Proactive and self-motivated

- Excellent communication skills

- Independent and has the ability to carry out a research project with partial supervision

- Ability to toggle between in-depth analysis and broader concepts

how are investment interns evaluated?

Interns are evaluated on their ability to independently diligence a topic, take a commercial approach to idea generation, and present an investment case that demonstrates independent thought. Interns receive structured feedback throughout the program, including a formal mid-summer check-in. An intern’s final assessment is a presentation to senior leadership.

how are data science interns evaluated?

Interns are evaluated on their ability to independently develop and pitch a creative solution to a challenging data problem that impacts the business. Interns receive structured feedback throughout the program and will ultimately be assessed based on a final presentation to senior leadership.

How to excel in a Viking interview

Review these suggestions to help position yourself for success during the interview process.

Ready to become a Viking?

Explore our current openings.

How to excel in a Viking interview

Review these suggestions to help position yourself for success during the interview process.

Ready to become a Viking?

Explore our current openings.

How to excel in a Viking interview

Review these suggestions to help position yourself for success during the interview process.

Ready to become a Viking?

Explore our current openings.

Viking at a glance

Our departments

Explore opportunities across our operations and investment teams.

Our investments

Gain a comprehensive understanding of our investment process.

Our Foundation

Learn how we make an impact in the communities in which we live and work.

Benefits and wellbeing

In addition to competitive pay, we offer comprehensive benefits packages that focus on the health and wellness of employees. Our benefits packages for full-time employees may differ based on role, region, or employment status.

Health and wellness

- 100% coverage of medical, dental, and vision premiums

- Paid lunches and fully stocked pantries

- Telehealth, virtual behavioral health, and employee assistance programs

- Wellness programming such as sleep seminars, CPR training, and mental health support

- Family benefits including fertility and family-building funding, navigation, and support

Investing and retirement

- Viking investment options for eligible employees

- Retirement plan with employer contributions

Work-life alignment

- 20 vacation days per year to start

- 25 vacation days after five years

- Hybrid working (by role)

- Onsite gym (by location)

*All benefits are subject to the terms and conditions of the applicable benefit plan or policy. Please contact us for more information.