Our investment process

We seek investment opportunities with compelling risk-adjusted return potential through our long-term fundamental research, strong relationships, and broad capital markets expertise.

Close and intentional collaboration across our investment team allows us to make informed investment decisions and deploy capital with agility.

Public equity

Our team covers approximately 900 publicly traded businesses around the world to identify attractive long and short investments and concentrate capital in ideas with the highest profit potential.

Industry specialists drive our investment selection process, allowing us to incorporate sector and company developments in real-time.

Private equity

We identify disruptive industry themes and businesses with exceptional management teams. Our vast industry network, reputation as a constructive capital partner, and targeted outreach allow us to source prospective private investments.

We empower business owners and management teams and contribute our industry knowledge and capital markets expertise to help them make strategic decisions.

Credit & structured capital

We employ a flexible and opportunistic approach to investing across private and public markets. We strive to be a responsive and creative solution provider for management teams and business owners seeking alternatives to traditional equity financing. For our investors, we seek to generate strong risk-adjusted returns by focusing on investments that combine downside protection and attractive return potential.

The structured capital team is integrated within our private equity team and works in close collaboration with the public equity team.

Our investment principles

DECENTRALIZED STOCK SELECTION

Our multi-portfolio manager structure is designed to distribute broadly the responsibility for identifying and selecting investments to members of our investment team who have subject matter expertise.

LONG AND SHORT INVESTMENTS

We invest in long and short single-name positions because we believe they enhance our analysis and performance and lessen market impact.

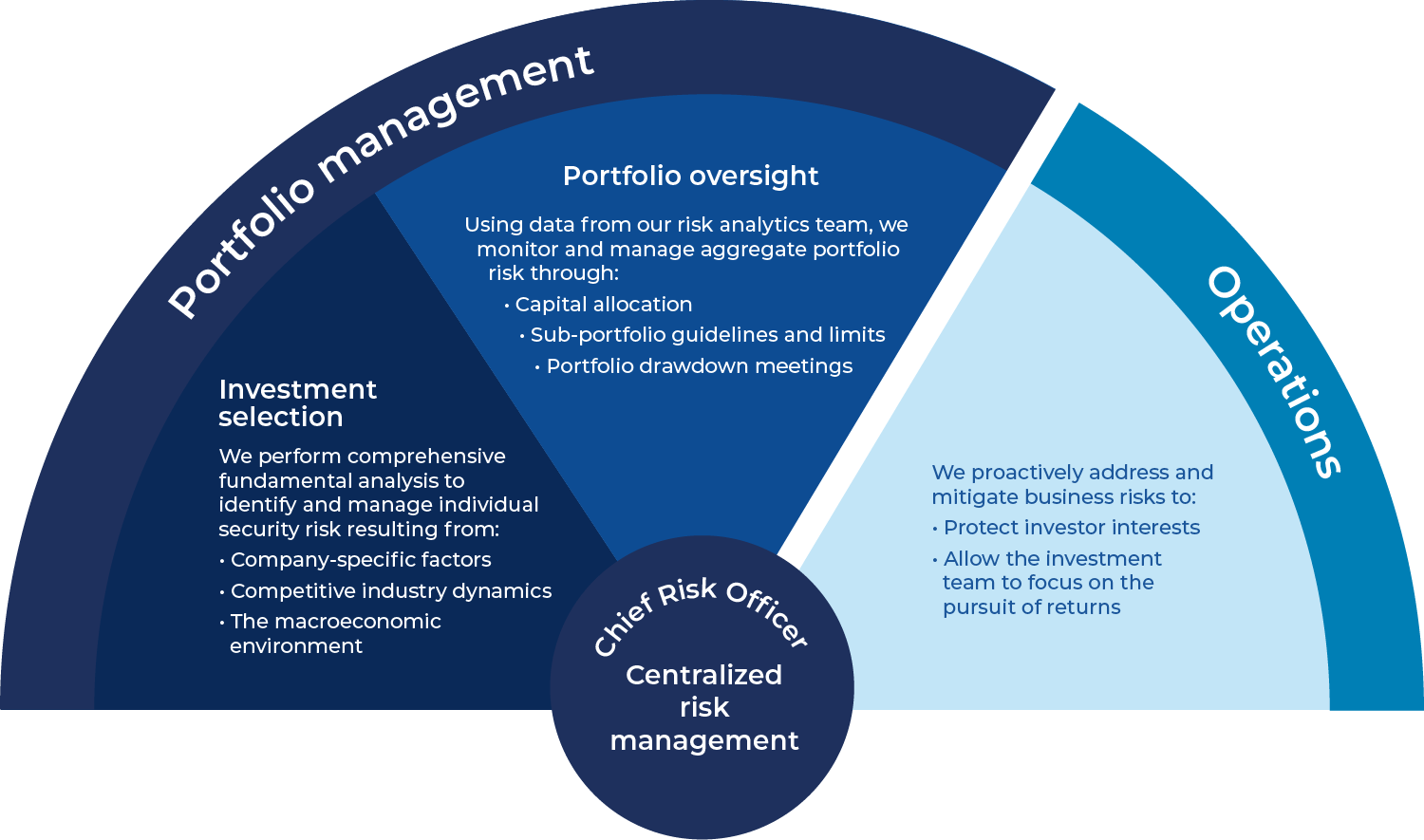

CENTRALIZED RISK MANAGEMENT

We centralize risk management to avoid the pitfalls of a committee approach and focus on aggregate portfolio level risk.

CROSS-TEAM COLLABORATION

Close collaboration within our investment team allows us to assess investment opportunities comprehensively and deploy capital quickly.

We perform research-intensive fundamental analysis on companies and industries with a particular emphasis on the strength of company management to develop conviction in our ideas. We conducted over 4,000 meetings with companies in 2025.

LARGE SCALE OPPORTUNITIES

We identify public opportunities globally from companies with more than $3 billion in market capitalization. Our private investment efforts generally focus on businesses that have opportunity to experience rapid growth and significant scale over time.

SECTOR SPECIALIZATION

Our analysts dive deep into specific industries, enabling them to respond nimbly to sector and company developments.

CAPITAL CONCENTRATION

We concentrate capital on our best ideas.

Strong collaboration between investment and operations teams

Our investment team conducts in-depth company research to deploy capital with speed and conviction. Research specialists support our investment process with proprietary data analysis as well as environmental, social, and governance (ESG), and regulatory diligence.

The operations team plays a critical role in helping our investment professionals act quickly. Through our robust operational infrastructure, we apply deep expertise in risk management, trade execution, compliance, cybersecurity, accounting, technology, talent, and relationship management.

Together, we bring our diverse strengths and individual accountability to create stronger outcomes for

our investors.

ESG integration

We believe companies that are well governed, socially responsible, and environmentally conscious are more likely to succeed over time. We seek to incorporate environmental, social, and governance (ESG) considerations into our investment process to the extent we believe they are material to a company’s business model, intrinsic value, or management practices.

By incorporating ESG factors into our investment framework and firm operations, we believe we can reduce risk, identify opportunities, and promote better investment and business outcomes.

Our ESG integration efforts are evolving. We do not necessarily identify all material ESG factors, nor do we identify ESG factors for all investments. To the extent we determine an ESG factor is material, we consider it as one of many factors in the investment process. We aspire to broaden and deepen our integration of material ESG issues over time.

RESEARCH

When we believe ESG is material to a company’s business model, intrinsic value, or management practices, we conduct company-specific and thematic research to capture and consider relevant topics in our investment process.

ISSUER DISCUSSIONS AND FEEDBACK

We seek to engage in discussions with some public and private companies and seek to provide them with feedback on ESG issues, share best practices, and make recommendations.

GOVERNANCE

We strive to be an informed shareholder and exercise our responsibilities in a manner that serves the best interests of our investors.

A disciplined approach to risk management

We believe that effective compliance practices and strong processes are key to protecting the interests of our investors and partners.

Become a Viking. Make an impact

Are you ready to help us identify the best ideas? Take the next step in your career and discover how you can add value to our investment team.